Segment Wise JSON fare of GSTR-1 to help IFF documenting

In the event that you have selected the QRMP plot, export section-wise JSON files in GSTR-1 using TallyPrime

From that point, on the GST portal,, you can transfer JSON documents of B2B Invoices and Credit/Debit Notes (Registered) for the first and second a long time of a quarter utilizing the Invoice Furnishing Facility.

Presentation of Oman VAT

TallyPrime upholds Oman VAT from 16-April-2021 for a wide range of exchanges.

Utilizing TallyPrime, you can

• Enable VAT

• Set VAT enrollment subtleties

• Configure charge rates for VAT

Tally improvement

Display Modes in TallyPrime

TallyPrime currently offers two Display Modes – Bright and Soft. While Bright is the default show mode, you can empower Soft showcase mode, according to your inclination, by going to F1 (Help) > Settings > Display > Color and Sound > Display Mode.

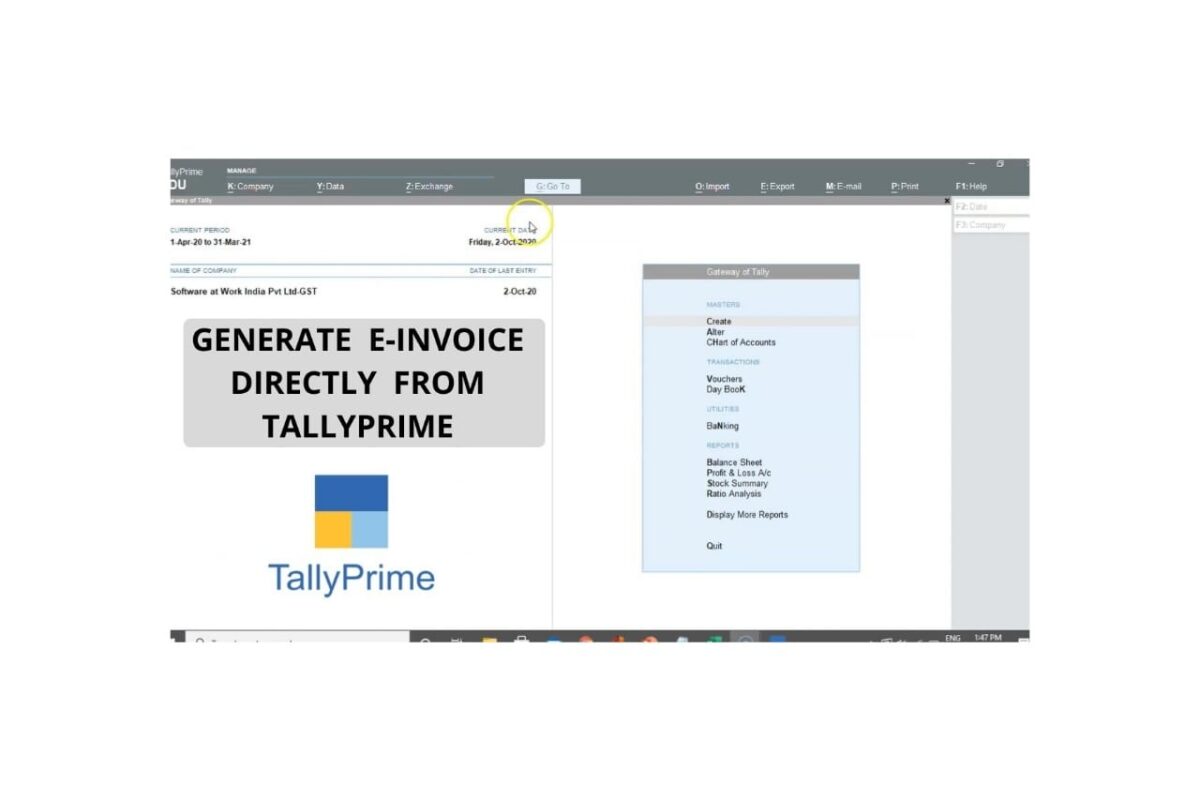

UNDO IRN Cancellation in Tally Prime

In the event that you have erroneously dropped an e-Invoice in TallyPrime, the Undo IRN Cancellation catch will assist you with fixing the wiping out.:

• Remove the reasons and comments of retraction from the voucher.

• Update the situation with an Invoice as not dropped in TallyPrime – in arrangement with the e-Invoice framework.

• Help you keep the e-Invoice report forward-thinking.

Carrier Name in e-Way Bill

At the point when you created the e-Way Bill alongside e-Invoice, the Transporter Name was not showing up in the e-Way Bill printed from the e-Way Bill entry.

This issue is settled.

Rejection of e-Invoice in view of negative free amount

e-Invoices were dismissed by the e-Invoice System, with the explanation given as negative free amount, in any event, when no free amounts were entered in the receipt.

This happened when UoMs with 4 decimals were adjusted to 3 decimals for a couple of stock things in the Invoice.

TCS rate imprinted in the Invoice

The TCS rate imprinted in the receipt was off base when various rates were set for Individuals and Other Collected Types in similar Nature of Goods.

This issue is settled.

Banking

Bank Reconciliation explanation (Kotak Mahindra Bank)

At the point when you utilized the Reconcile All Unlinked highlight in the wake of bringing in a bank explanation, a MAV blunder happened in the Bank Reconciliation proclamation.

This issue is settled.

Printing of checks in vertical mode

Checks were getting imprinted in scene mode in any event, when you had set the arrangement as Vertical Center in the bank record.

This issue is settled.

Incapable to save Contra voucher opened from BRS

The Voucher aggregates don’t coordinate with message showed up while saving a Contra voucher from the Bank Reconciliation articulation.

This happened when you made a Payment voucher from BRS subsequent to bringing in a bank explanation, and afterward changed the voucher type to Contra.

This issue is settled.