E-Invoice known as ‘Electronic invoicing’ is a framework in which all B2B solicitations are electronically transferred and confirmed by the assigned entry. Post fruitful confirmation, a special Invoice Reference Number (IRN) is produced for each receipt by IRP. This cycle is by and large called as e-invoicing under GST.

What is IRN?

IRN known as “Invoice Reference Number” is a unique receipt number produced by the Invoice Register Portal (IRP) on transferring the solicitations electronically.

Under the e-invoicing framework in GST, reports, for example, receipt, Credit Note, Debit Note or any such record as needed by the law should be electronically transferred to IRP framework.

Parameters and format of IRN

The IRN is figured thinking about the GSTIN of a generator of the archive (receipt or credit note and so forth), record number like receipt number and the monetary year.

• Supplier GSTIN,

• Supplier’s receipt number

• Financial year (YYYY-YY)

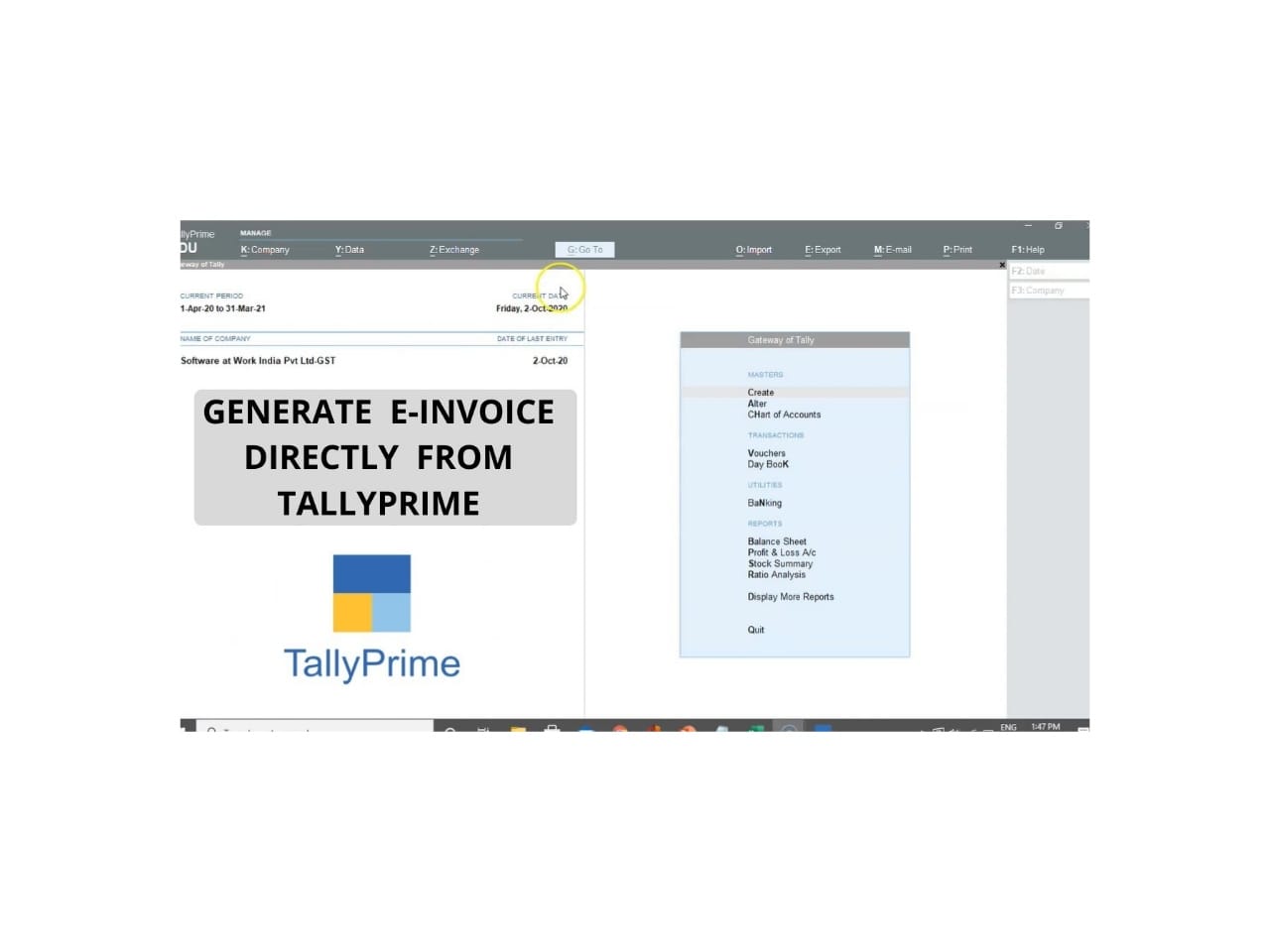

How to create e-Invoice?

Step – 1 Creation of e-receipt JSON: The initial step is to make the receipt JSON utilizing the bookkeeping programming. The citizen can create it either utilizing ERP programming or utilizing the disconnected utility.

Step – 2 Uploading of JSON: In this progression, the receipt JSON for each B2B receipt produced utilizing bookkeeping programming or some other utilities are transferred to the IRP framework. In the event that the ERP programming is incorporated with IRP through GSP, the transfer of the JSON record will be mechanized.

Step-3 Verification of e-receipt JSON: In this progression, IRP framework approves the e-receipt JSON and checks the focal vault of GST for any duplication.

Step-4 Generating receipt reference number (IRN): After effective approval of e-receipt JSON, IRP framework will create IRN. IRN created will be a special number of each receipt for the whole monetary year.

Step-5: Receiving carefully scorched e-receipt JSON: Here, the carefully marked e-receipt JSON alongside QR code is shipped off the provider. The IRN and QR code will be imprinted on the receipt prior to giving it to the purchaser.

Step-6 Transfer of information to e-way charge framework and GST framework: The receipt JSON information transferred, will be imparted to the e-way bill and GST framework, for getting ready e – waybills and for auto-populace of GST return:

• Part-An of e-way will be auto-populated with e-receipt information

• GSTR-1 of the provider will be auto-populated according to the e-receipt subtleties transferred into IRP entryway

• GSTR-2A will be refreshed, giving an ongoing perspective to the purchaser